- Built a scalable component library to ensure UI consistency across modules and regions

- Enabled faster development cycles and rollout of UI enhancements

- Aligned with accessibility and usability fintech benchmarks

Site Search

Modernized a Banking Giant’s Mobile App to a socially engaging Fintech Solution with enhanced UX compliance

-

300%

Growth in positive app store reviews

-

25%

Increase in user registrations post-launch

-

35%

Rise in avg time users spent on the platform

About the Client and Project

A globally recognized banking and financial services leader, serving hundreds of millions of users, sought to modernize its traditional systems to compete in the fast-evolving fintech landscape. Despite its strong reputation, the bank’s outdated technology limited its ability to deliver the agility and innovation expected by today’s users. Unified Infotech was engaged to design and develop a cutting-edge digital banking platform that would redefine the client’s digital presence.

Our team delivered a sophisticated digital ecosystem, integrating social engagement, data-driven personalization, and intuitive workflows while ensuring enterprise-grade security and scalability. The result was a user-centric, fintech-grade platform that enhanced customer experiences and met stringent compliance standards, positioning the bank as a forward-thinking leader in the industry.

Industry

Banking and Financial Services

Project Duration

6 Months

Team Size

8

Client Location

Singapore

Engagement Model

Time and Material

Build Your Idea

Consult Our Experts

Background and Strategic Fit

As a global banking leader, the client faced critical challenges, like legacy digital systems, decentralized workflows, and inconsistent CX across geographies. These limitations were compounded by an increasingly competitive fintech landscape where agility, usability, and real-time access are now non-negotiable.

- Legacy silos and outdated UX hindered CX, internal productivity, and cross-channel consistency.

- Regional workflow and system variations made global coordination and updates slow and costly.

- Digital-native users demanded intuitive, responsive, and self-service-friendly financial interfaces.

- Redundant processes and excessive manual interventions resulted in operational inefficiencies.

- Fintech trends and regulatory reforms required a more agile, modular foundation.

The objective was to transition from disjointed digital operations to a cohesive, scalable, and user-focused platform designed to drive growth and align with contemporary user expectations.

Services Offered

Challenges

Merging Banking Rigor with Fintech Agility

Traditional banking portals are characterized by regulatory compliance and operational rigidity. Additionally, fintech platforms thrive on user-centric agility. Balancing these opposing paradigms was a key challenge.

Designing for Financial Trust

The interface needed to convey trust, transparency, security, and control, the core pillars of any financial platform, while maintaining its aesthetics.

Embedding Social Features in Finance

Integrating community-driven social tools within a financial ecosystem required careful planning to balance user engagement with data privacy and compliance protocols.

Abstracting Complexity

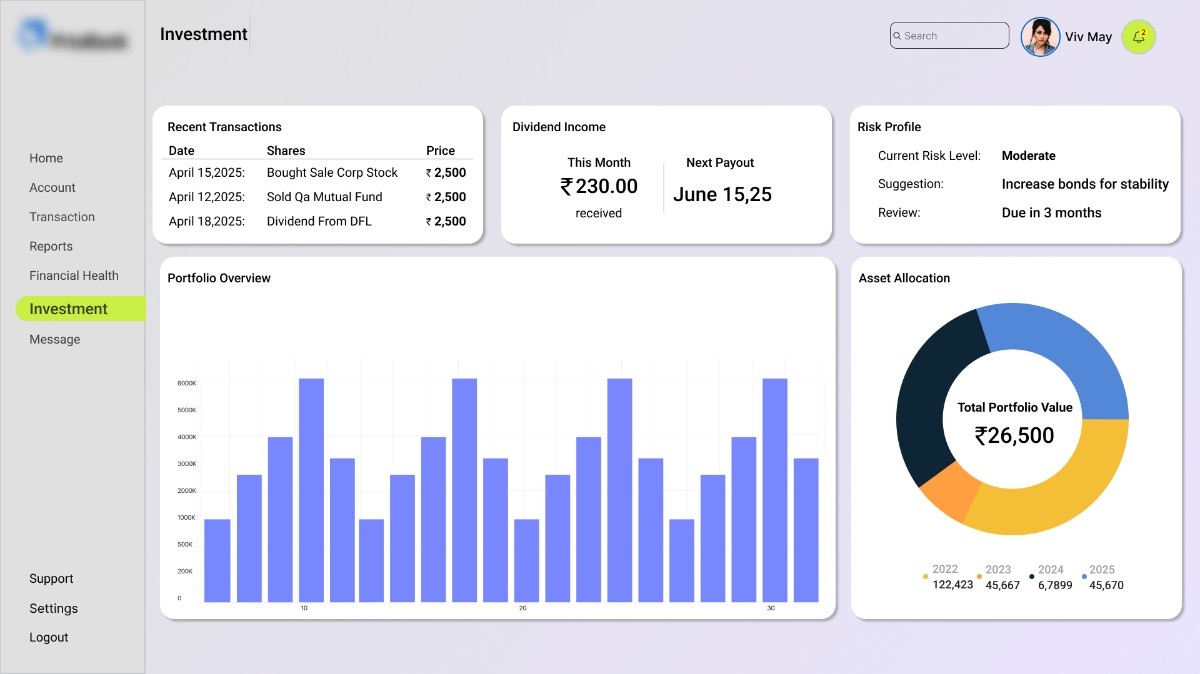

Transforming intricate, data-dense financial products into clear, interactive visualizations, preserving full functionality and accurately representing risk.

Orchestrating a Global, Modular Rollout

Supporting multiple markets meant we had to build a modular architecture flexible enough to support localization, regional compliance, and market-specific features without fragmenting the core codebase.

Client Goals

The client sought to modernize its digital banking platform to align with current fintech standards and the expectations of digital-native users. Key objectives included:

- Redesigning the UI to deliver a seamless, intuitive experience across web and mobile, aligned with modern fintech usability standards

- Unifying the platform architecture to eliminate regional inconsistencies and support scalable deployments with shared logic and localized flexibility

- Boosting user engagement by refining onboarding flows, increasing session duration, and integrating social elements for a younger audience

- Streamlining operations by integrating self-service workflows, reducing manual dependencies, improving transaction speed and support efficiency

- Future-proofing the platform with a component-based design that supports faster rollouts of advanced features like real-time insights and personalization

Solutions Provided

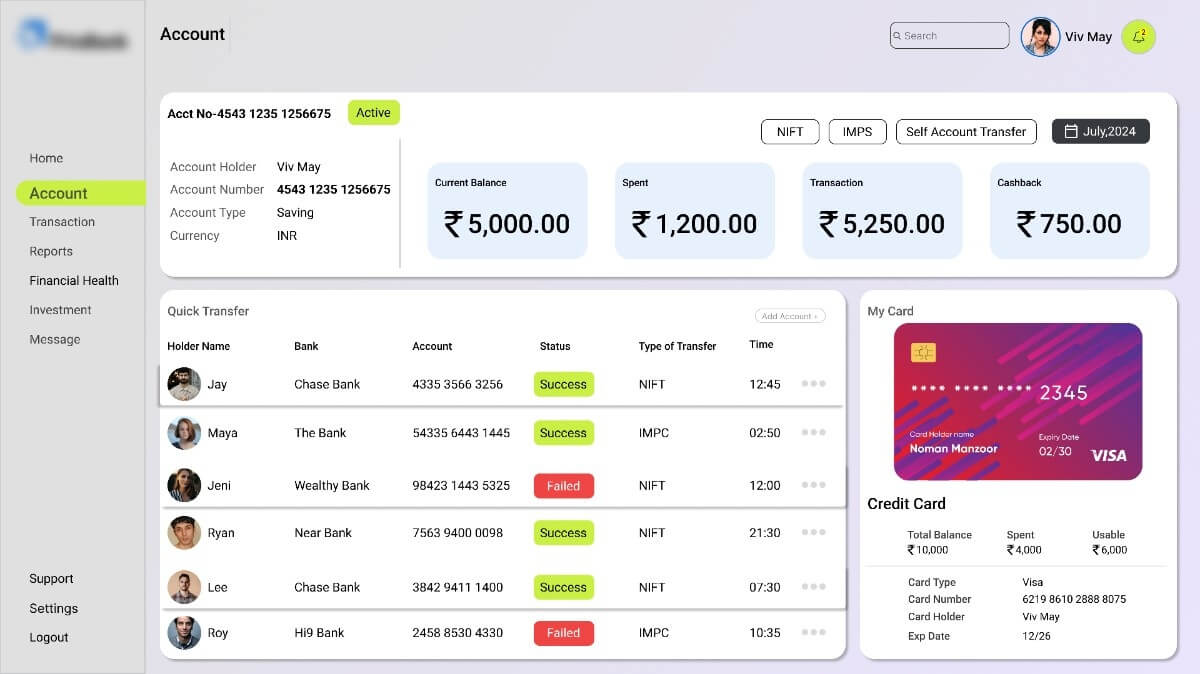

We helped the client optimize real-time banking interactions and financial data visualization.

Fintech-Inspired Design System

Mobile-Optimized Architecture

- Developed responsive front-end optimized for cross-device banking experiences

- Ensured intuitive interactions across touchpoints, from account views to micro-interactions

- Leveraged lightweight, modular components for fast rendering and improved performance

Experience-Driven Workflow Design

- Refined onboarding, account management, and self-service features

- Introduced contextual cues, smart validations, and real-time feedback to reduce user friction

- Prioritized data clarity and actionability across high-sensitivity tasks like transactions and updates

Social Layer Integration

- Embedded activity feeds and localized offers to drive in-platform engagement

- Enabled check-ins and user interactions within a secure banking context

- Balanced social features with financial compliance and data governance standards

Context-Aware Micro-Interactions

- Integrated micro-animations to guide users during sensitive financial tasks

- Delivered inline validations, nudges, and feedback to reduce friction and improve form completion rates

- Used visual cues to reinforce trust and clarity in high-stakes workflows like payments and verifications

Security-Centric UX Enhancements

- Implemented two-factor authentication with clear UI flows

- Designed session timeouts, device alerts, and login transparency as part of the UX layer

- Maintained enterprise-level encryption protocols without compromising user convenience

Key Functionalities

The platform delivered a responsive, socially enriched, mobile-first digital banking experience

Technology Stack

-

- Hosting: Ensure smooth delivery and performance of the web application

- UI/UX: Wireframing, prototyping, and polished interface design aligned with brand guidelines

- Frontend: Create a responsive, browser-compatible interface with smooth user interactions

- Backend: Form submissions, user data management, and server-side logic

- APIs and Connectors: Power real-time features like maps, account details, and contextual offers

- Mobile: Develop intuitive, high-performance cross-platform apps for iOS and Android

- Database: Design and manage scalable databases for secure and efficient data storage and retrieval

- Version Control Systems: Support collaborative development and source code management

Results

The new digital platform delivered measurable improvements across user engagement, system efficiency, and growth readiness. It successfully bridged the gap between enterprise banking standards and fintech-grade user experience, allowing scalability, better services, and reduced operational friction across markets.

Key Outcomes:

- Increased user registrations within the first quarter post-launch

- Extended session time and repeat usage, especially on mobile devices

- Reduced support requests due to improved self-service features

- Accelerated page load times for smoother cross-device transitions

- Strengthened brand perception among younger, tech-savvy audiences

- Improved roll-out efficiency and data governance

300 %

Growth in positive app store reviews

25 %

Increase in user registrations post-launch

35 %

Rise in avg time users spent on the platform