- Email addresses registered as Super Admin have exclusive access to the permission sheet

- The SuperAdmin has the authority to change user permissions even when the user is logged in

- Permission changes take effect almost immediately without requiring manual intervention

- Role-based access allows users to see menus and submenus relevant to their assigned roles, preventing unauthorized access

- Additional permissions can be granted to a user as extra functionalities, dynamically updating the interface

Site Search

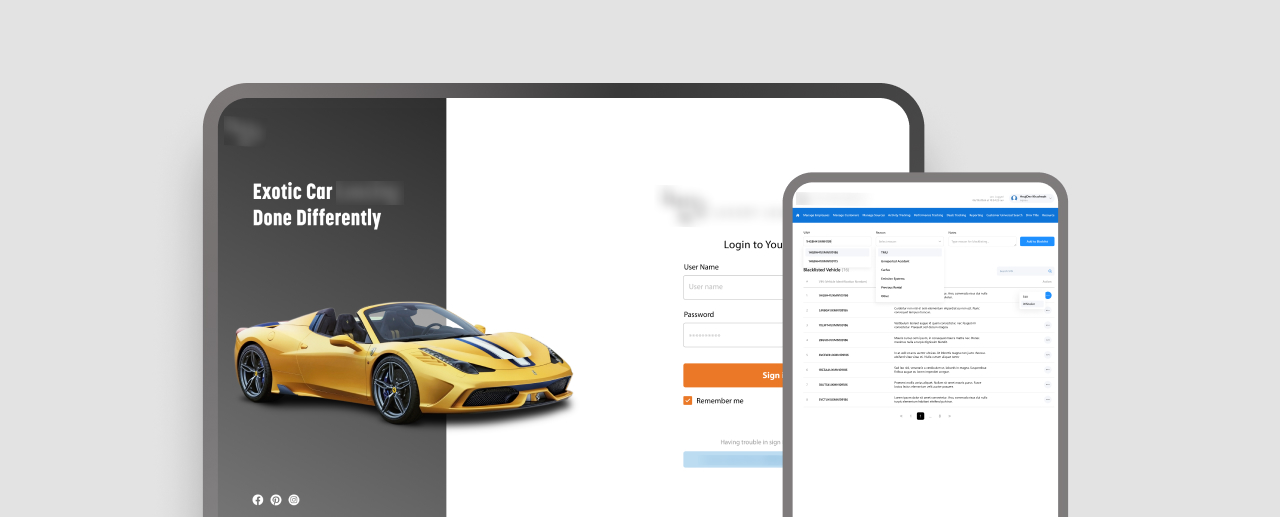

Custom-engineered a sophisticated web application, transforming leasing with Fast & Automated Car Financing Solutions

-

70%

Reduction in approval process time

-

25%

Improvement in operational efficiency

-

35%

Increase in customer satisfaction score

About the Client and Project

This client specializes in offering alternate financing for high-end luxury brands like Ferrari, Rolls-Royce, Lamborghini, etc., to individuals and through a network of dealers. They come with decades long leasing experience and are also credited with introducing a non-banking finance program and other expanded leasing options to people with excellent credit. Unlike conventional lenders, approvals here are not limited to credit scores only. They also focus on the borrower’s ability to meet payments. Consequently, their customers generally maintain strong equity positions that allow them the flexibility to exit early, upgrade their vehicle, or even sell it.

Unified was called in to build a platform that would make dealer/customer interactions easy and convenient. They had to automate the entire process, from requirement procurement to sending the required quote. Customers seeking luxury leases will use this platform to submit their requirements so the client can assess their eligibility and calculate a potential lease payment. Unified also had to automate its entire sales network and ensure real-time data analytics.

Industry

Automobile and Consumer Finance

Project Duration

Underway

40 months

Team Size

5 to 6

Client Location

New Jersey, USA

Engagement Model

Time and Material

Build Your Idea

Consult Our Experts

Background and Strategic Fit

The client’s existing leasing process relied on manual calculations, spreadsheets, and slow approval cycles. Thus, they faced significant delays in the processing of lease applications. There was no transparency, and the chances of errors and mistakes were very high. Further, manual processes offered limited scope for business growth and scalability.

- The client needed a centralized self-serving platform for managing dealership leasing requests and approvals.

- They wanted to automate the leasing decisions through real-time eligibility checks to make it quick and convenient.

- A scalable solution would also cater to increased demands for automobile leasing by dealers and individual customers.

- The need was for a user-centric design that would interact seamlessly with third-party solutions like vehicle evaluation services, MMR, Blackbook, etc.

Unified Infotech aimed to build a solution that included a tool to calculate eligibility for this alternate leasing program while augmenting the sales team through excellent backend management.

Services Offered

Challenges

Complex Financial Logic

Developing the lease calculator involved integrating multiple financial logic. While the client provided the logic, we had to understand it thoroughly before converting it into codes.

Automating Daily File Processing

Managing the daily inflow of files from third-party providers and ensuring timely distribution to the right recipients was a significant challenge. Previously, this process was carried out manually. We had to revamp the entire process of fetching multiple files from third-party sources and distributing them to appropriate recipients without any manual intervention within a specified time of the day.

Current System Not Robust

The current system being used was neither robust nor user-friendly. There were pagination issues, and no data was loaded when a page was opened. Only after manually selecting the data would the page get populated. We had to address all these issues on the new website.

Windows Server Deployment on AWS

Deploying and customizing a Windows Server on AWS was one of our most significant challenges. It was a complex task because of the multiple constraints and approval requirements. Further, the existing Microsoft server was outdated, making migration and custom configuration even more difficult. The primary goal was to migrate all data to the cloud so the data analytics team could process and generate real-time insights. The sales team also needed instant access to sales-related data to track performance and make informed decisions. Despite all the obstacles, we executed the task successfully.

Client Goals

By opting for an automated tool to simplify the workflows of the alternate leasing program, the client wanted to:

- Automate the entire process of eligibility checking for the alternate leasing program

- Bring transparency into the leasing program by enabling dealers and individuals to calculate the potential payment required for a high-end car lease

- Empower their data analytics team with access to real-time data for better decision-making and improved performance tracking

- Redesign their website to make it more user-centric, convenient, visually compelling and functionally excellent

Solutions Provided

We developed a solution aligned with the client’s needs through extensive analysis and research.

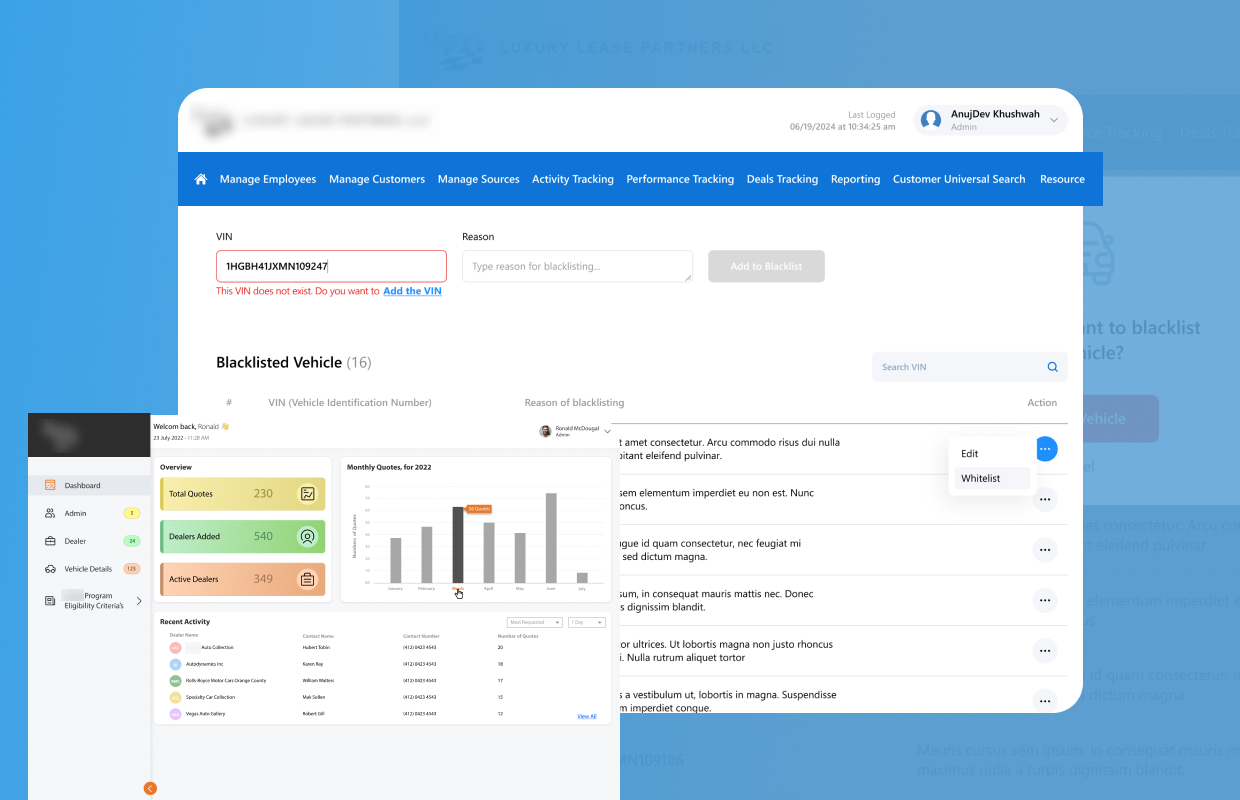

Role-Based Access Control

Dealer/Customer Panel

- Dealers access the portal through a secure login using their registered email and password

- All login attempts are logged, capturing details such as account ID, device information, IP address, location, and timestamp for auditing purposes

- The system ensures secure authentication and prevents unauthorized use by generating a new access token for each new session

- Dealers receive a six-digit OTP valid for only 1 minute, which they must use to complete the email verification process

Dealer Profile Management

- Dealers have a dedicated profile management screen that displays their business name, contact details, and account status

- Dealers have the option to edit and update personal and business details, including business address, contact number, and email

- Logout automatically closes all active sessions, and the logout details get recorded for tracking and security purposes

Lease Calculator Form

- Dealers can input key financial and vehicle details in a structured form that dynamically calculates lease eligibility and estimated payments

- Mandatory field validation prevents incomplete submissions by displaying error messages when required information is missing or incorrect

- The system processes data automatically by integrating with third-party APIs to validate inputs, such as vehicle valuation and customer financial standing

- The lease calculator applies predefined logic to calculate estimated monthly payments, residual value, and tax obligations based on input data

- Under vehicle details dealer has to fill in the VIN Number if available

- If VIN number not available, dealers must fill all the mandatory fields manually; the eligibility check will happen based on this

- Dealer has to provide the purchase price of the vehicle, fees applicable, etc., under the financial details field

- Inputs required under customer details include customer credit score, annual income, etc.

Output Non-Binding Payment Quote

- The system generates a non-binding estimated lease payment that includes the base monthly payment, taxes, and total due at signing based on the input received

- The quote provides a full breakdown of leasing costs, covering total capitalized cost, lease acquisition fees, dealer fees, and service contract fees

- Contact details for client support are included in the generated quote, ensuring customers can reach out for additional clarification or assistance

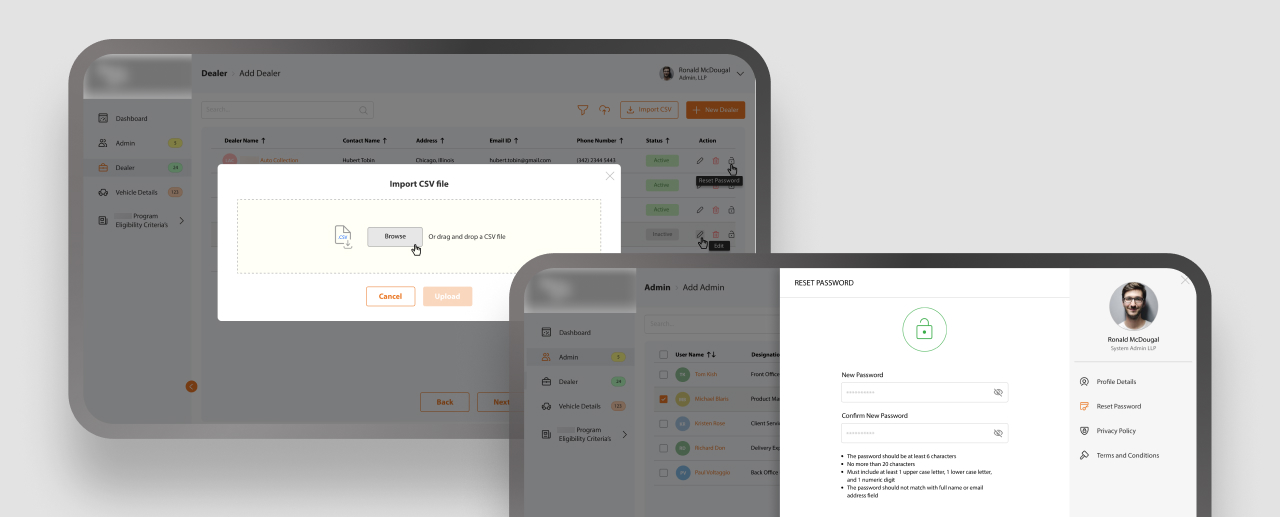

Admin Management

- Centralized interface with a dedicated dashboard to manage user access, dealer accounts, and system configurations

- Support for multiple device logins for administrators

- Activity tracking ensures security and compliance

- Admins can search, filter, and sort user lists based on role, status, or last login date

- Super Admins can add, edit, or deactivate dealer accounts while limiting access for standard administrators

- Audit log helps track all significant administrative actions, including permission changes, account modifications, and system updates

Lease Program Criteria

- Credit tier mapping helps structure the lease approval based on predefined credit score bands, assigning terms, etc

- Lease terms, including duration and interest rates, are customizable

- Automatic tax calculations and adjustments based on state-specific regulations and vehicle classification for accurate pricing

- Presence of specific eligibility restrictions to prevent ineligible cars from being processed for leasing

- Lease criteria updates are instantly applied across the platform

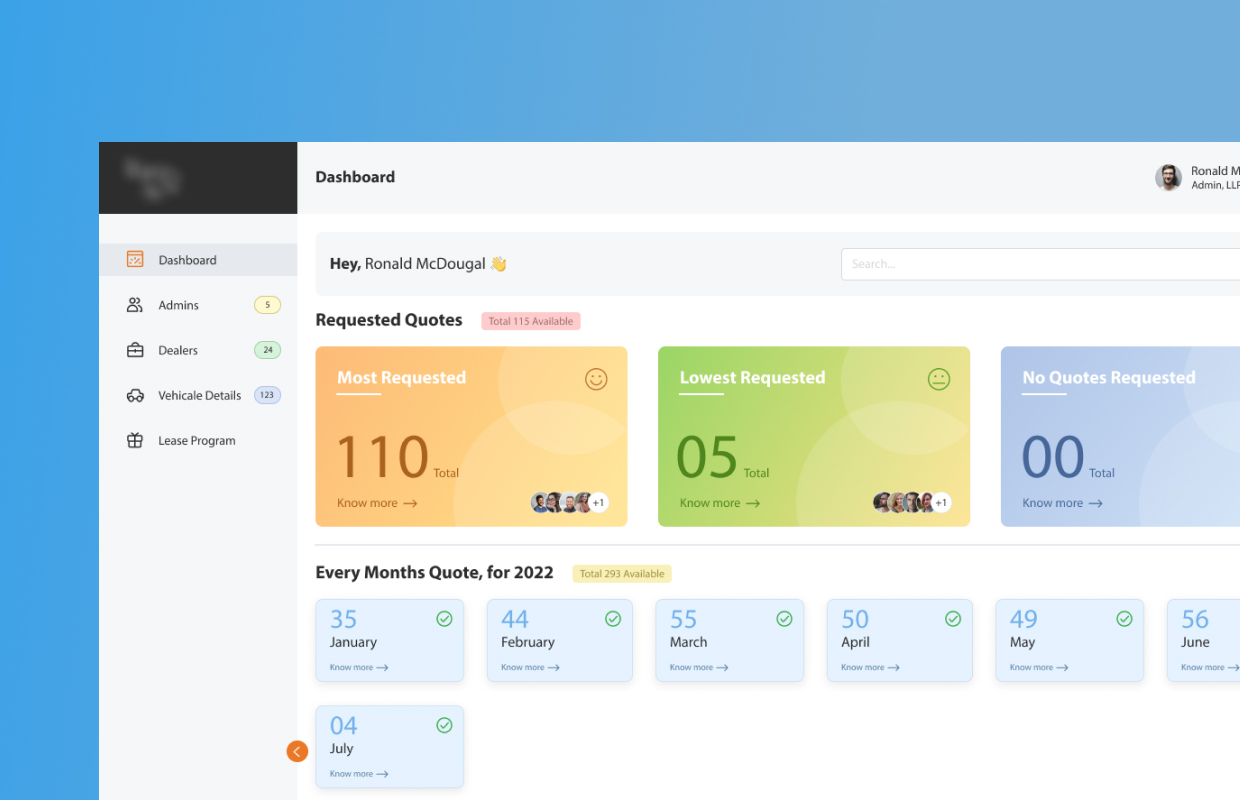

Homescreen Dashboard

- Admin dashboard equipped to provide a centralized view of key performance indicators, including total lease quotations, active dealers, and monthly trends

- Recent dealer activity also gets highlighted, displaying top-performing dealers who have generated the highest number of lease quotes

- Quick action buttons for user account management, system settings updation, and real-time monitoring of leasing metrics

- Graphical data representation through charts and trend lines offers an intuitive overview of business performance and leasing activity

Key Functionalities

Custom-built a fully automated lease approval system and redesigned the sales portal for convenience, aesthetics, and performance

Technology Stack

-

- Content Delivery Network: Helps accelerate content delivery for better performance

- Project Management Tool: Centralizing information to provide better visibility into project progress

- Design: To facilitate intuitive navigation and visually engaging interfaces

- Frontend Technologies: Help enable seamless interactivity and smooth user experience

- Backend Technologies: Chosen for high performance, scalability, and secure data processing

- APIs and Connectors: To facilitate the seamless exchange of data between systems

- Application Server: To optimize the app for high availability, reliability, and fast execution

- Database Server: Configured for secure, scalable, and high-speed data processing

- Database: PostgreSQL for sales, SQL for Windows and MongDB for efficient data storage, retrieval, and management

- Third-Party: Expanding app functionality through external service connections

- DevOps: For automated deployment, testing, and continuous integration workflows

- Version Control Systems: To streamline version control and enable collaborative code management

Results

Automating the lease approval process significantly improved its efficiency and accuracy and reduced the time required to generate a non-binding quote. It also allowed dealers direct access to customer assessments, eliminating the need for manual back-and-forth communication.

Enhanced security measures, including role-based access control and authentication layers, strengthened data protection and compliance. The scalable architecture of the custom web application also helped accommodate more dealerships as the business grew. Integrating third-party APIs made vehicle valuation and financial data validation easy, reliable, and accurate.

The transformation further provided better visibility into leasing trends, enabling data-driven decision-making by facilitating real-time tracking and improving reporting capabilities.

70 %

Reduction in approval process time

25 %

Improvement in operational efficiency

35 %

Increase in customer satisfaction score